Published March 3, 2025

By Lindsay Fenlock, Senior Researcher at the Center for International Environmental Law, and Charles Slidders, Senior Attorney, Financial Strategies at the Center for International Environmental Law, and Nikki Reisch, Director of the Climate & Energy Program at the Center for International Environmental Law.

This is the fifth analysis in a multi-part series analyzing the intersection of the climate emergency and the insurance crisis.

The deadly fires that devastated Los Angeles and displaced hundreds of thousands of people in January have been finally contained, but they left another sort of firestorm in their wake — one raging around the insurance industry and its shrinking coverage of climate risks such as extreme wildfires. Climate change increased the likelihood and severity of the fires — by far some of the most destructive in the city’s history. The blazes killed at least 28 people and destroyed some 16,000 structures over nearly 50,000 acres — an area larger than the city limits of San Francisco. Insured property damage alone is expected to reach as much as $40 billion. The question of who pays looms large.

For at least fifty years, the insurance sector has been aware of the physical risks of climate change and that greenhouse gas emissions, primarily from fossil fuels, are overwhelmingly responsible for rising temperatures. Despite this, US insurance companies have investments of more than $500 billion in fossil fuel-related assets. The underwriting business of major insurers remains heavily focused on the fossil fuel sector, with the top US insurers of fossil fuel businesses earning $5.2 billion from underwriting in 2023.

After decades of pocketing premiums from homeowners and investing significant portions of that money in the fossil fuel industry that drives climate change, private insurers like State Farm and Berkshire Hathaway carved out fire coverage from their policies or pulled out of the California market altogether.

The result: The insurers that played a role in facilitating the very climate disasters now affecting their former customers have effectively cut and run, leaving the residents and the state holding the bag.

Private insurers will escape the full bill, largely because they have shifted their exposure to the most extreme climate risks to California’s insurer of last resort — the FAIR Plan. In abandoning the California home insurance market, or otherwise excluding fire coverage from their policies, private insurance companies effectively pushed the responsibilities of shouldering climate risk back onto the public and protected their own profits. Despite their claims to the contrary, insurance companies, as recently as 2023, generated significant profits on homeowner insurance policies and are still raking in record profits.

The FAIR Plan is now on the brink of insolvency. To fund the shortfall, the California Insurance Commissioner has levied an assessment totaling $1 billion on private insurance companies. However, private insurance companies will pass $500 million of the assessment on to all of California’s insured homeowners.

This $500 million bill is a direct consequence of climate change and the profit-driven insurers who — after pocketing ever-increasing premiums and investing in the fossil fuel sector — have shed policies for homes most vulnerable to climate risks. All of California’s home insurance policyholders are the victims of fossil-fueled climate change.

Insurers Abandon Californians

The destructive force of the LA wildfires is a result of climate change-induced drought, which led to the accumulation of dried-out vegetation and the perfect conditions for extreme wildfires. Unusually strong wind gusts of more than 100 miles per hour spread the fires across LA, scattering flames throughout many of the city’s communities. And it was not just the fires causing damage — climate change intensifies fire smoke, filling the air with hazardous pollutants that harm health.

In California, the frequency and severity of wildfires have increased the cost of disasters, prompting insurers to hike premiums or refuse to renew policies. California’s home insurance rates jumped 48.4 percent from 2019 to 2024. Twelve major insurers have also restricted homeowners insurance even after being allowed massive rate hikes.

Insurers have justified abandoning California homeowners by citing rising climate risk. Yet, insurance companies are complicit in facilitating climate change through their massive investments in fossil fuel-related assets — including coal, oil, and gas — the primary sources of the greenhouse gases driving climate change.

State Farm and the Hypocrisy of the Insurance Sector

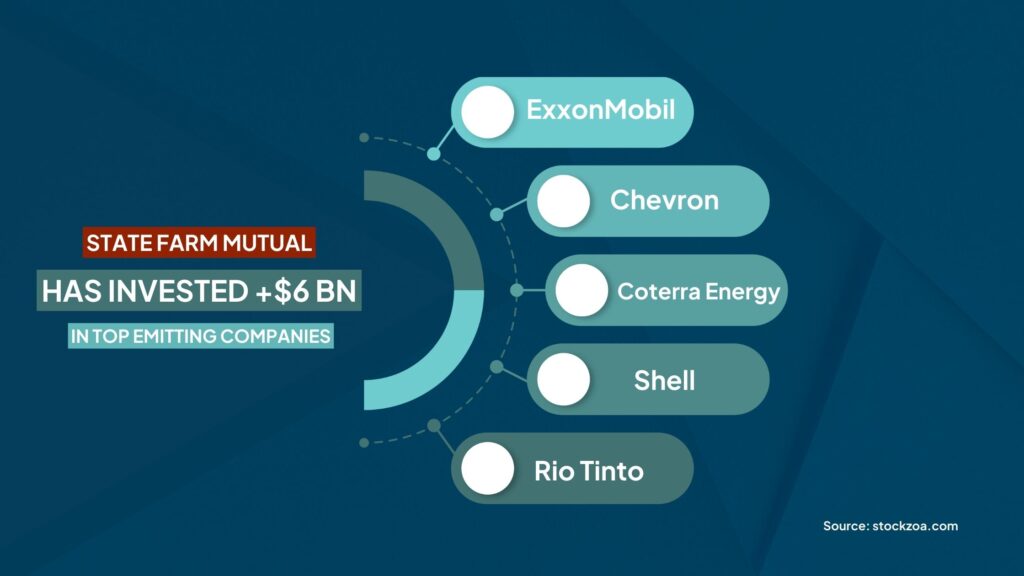

State Farm General (State Farm) — through its parent company, State Farm Mutual — is a major investor in fossil fuels. The company’s investments include more than $6 billion in upstream oil and gas producers ExxonMobil, Chevron, Coterra Energy, and Shell and mining company Rio Tinto. These five companies sit on the list of the top investor-owned entities with the highest historical carbon dioxide emissions. State Farm Mutual also has billions of dollars of investments in fossil-fuel-intensive or dependent industries such as utilities, oil and gas services, and pipeline companies, as well as chemical, steel, and fertilizer manufacturers.

Despite facilitating climate change through its fossil fuel investments, State Farm — the largest property and casualty insurer in California — stated in 2023 that it would not renew 30,000 home insurance policies in the state. The decision was primarily due to the increasing risk of wildfires in California. After an approved rate increase of 20 percent in December 2023, amongst other concessions from the California Department of Insurance, State Farm agreed to renew these 30,000 home insurance policies, but only on the condition that the renewed policies exclude fire coverage. State Farm clients had to specifically secure separate fire coverage from the FAIR Plan.

The Pacific Palisades, one of the neighborhoods devastated by the LA Fires, was one of the zip codes abandoned by State Farm. According to California Department of Insurance spokesperson Michael Soller, State Farm dropped about 1,600 policies in Pacific Palisades in July. State Farm also dropped more than 2,000 policies in two other LA zip codes, which include neighborhoods also damaged by the wildfires, such as Brentwood, Calabasas, Hidden Hills, and Monte Nido. The FAIR Plan is now the principal recourse for wildfire coverage for former State Farm policyholders.

State Farm Demands Rate Hike Instead of Using Reinsurance Profits

Most private insurers are looking to their reinsurer to provide coverage for their losses from the LA Fires. Reinsurance, basically insurance for insurance companies, is a common part of an insurer’s business model as it allows them to shift some of their risk to protect themselves from the most catastrophic events. State Farm’s reinsurer is its parent company — State Farm Mutual. From 2014 to 2023, State Farm paid reinsurance premiums of nearly $2.2 billion but was only reimbursed $0.4 billion — less than 20 percent — suggesting that the company overpaid for reinsurance. These payments to its parent company, with little return, led to accusations that State Farm was artificially boosting its parent company’s profits.

State Farm Mutual has over $130 billion in surplus available to support its subsidiary. Despite the exorbitant profits of its parent company and well before the LA Fires, in June 2024, State Farm requested a 30 percent increase in its homeowners insurance rates (on top of the 20 percent increase it was granted in March of the same year) purportedly to improve its general financial condition. Within days of the LA fires being contained, State Farm again asked its California policyholders to step in and maintain the profits of its parent company. State Farm requested an annual $740 million bailout in the form of an “urgent” 22 percent increase in State Farm’s home insurance rates, as well as requesting rate hikes of 38 percent for rental dwellings and 15 percent for tenants.

Fortunately for California’s consumers, Commissioner Ricardo Lara rejected State Farm’s requested rate increase. And true to form, State Farm is now “considering its options” because the Commissioner’s decision “sends a strong message to State Farm General about the support it will receive to collect sufficient premiums in the future” — a barely veiled threat to again abandon California policyholders.

State Farm had already limited its exposure to climate change-induced wildfires and then sought to reduce it further, asking policyholders to take on even more of the remaining risk. All the while, they continue to facilitate climate change and profit from their fossil fuel investments.

Climate Change Pushes FAIR Plan to the Brink

As insurance companies pull out of vulnerable areas or raise premiums, many California homeowners are left with no choice but to rely on the FAIR Plan — the state-supported insurer of last resort. The FAIR Plan offers limited coverage at higher rates, making it costly and an inadequate safety net for homeowners abandoned by private insurance companies.

The exit of insurers from the California residential property market has meant that the FAIR Plan’s exposure to wildfire risk has increased exponentially. The FAIR Plan now holds 13,752 policies with more than $23 billion in liability across the residential and commercial sectors in the zip codes affected by the fires.

On February 11, 2025, Insurance Commissioner Lara found “that the FAIR Plan is faced with a substantial threat of insolvency due to unprecedented losses” and approved the FAIR Plan’s request to levy an assessment totaling $1 billion on private insurance companies. Before July 2024, insurers operating in California would have been solely required to fund any deficit, paying a fee based on their market share. But a July 2024 regulation allows insurers to shift 50 percent of the assessment onto the state’s existing policyholders. Homeowners from all over California are being asked to bail out the FAIR Plan, irrespective of the risk profile of their home and neighborhood and the climate risk mitigation or adaptation they have undertaken.

This change in regulation was part of a series of concessions Lara has given to the insurance industry in recent years, including provisions that make it easier for companies to raise premiums and a new rule that allows companies to use forward-looking catastrophe models when setting rates. These new regulations were aimed at convincing insurers to stay in California, but consumer advocates warn that they have the potential to further exacerbate homeowners’ climate-related costs.

Making Insurers Take on the Real Culprit of Climate Change

Insurance companies facilitate climate change by investing in fossil fuel assets and underwriting fossil fuel projects. However, the primary drivers of climate change are fossil fuels themselves, and it is the companies that produce and sell them that are principally responsible for the climate emergency. Instead of attempting to shift their exposure to California’s householders, insurers should divest from fossil fuel assets and cease underwriting fossil fuel projects. Insurers should then seek to recoup the costs of covering the damage from climate change-induced severe weather events from fossil fuel companies — not from the individual policyholders or the public at large.

A new bill, SB222, introduced into the California legislature, would make it easier to ensure that polluters pay for the climate-driven disasters befalling residents and upending the insurance industry. It specifically directs the FAIR Plan and incentivizes private insurers to pursue the parties responsible for climate change-induced weather events by standing in the shoes of policyholders to recoup the costs of losses, utilizing their right of subrogation. An insurer’s right of subrogation is the right to try to recover the amount of a claim or claims it paid out from another party that caused the insured loss(es).

The draft legislation directs the FAIR Plan to exercise its right of subrogation against “a responsible party for a climate disaster or extreme weather or other events attributable to climate change” if the benefits of subrogation outweigh the costs (as determined by an independent advisory body). If the FAIR Plan’s funds are exhausted and private insurance companies are being assessed, as is the case now, the Bill also provides incentives to insurers to exercise the right of subrogation against a “responsible party” for a climate disaster. An insurer’s share of the assessment will be reduced by 10 percent if the insurer exercises its right of subrogation against a responsible party, but if it does not exercise its right of subrogation against a responsible party, it will be increased by 10 percent.

Finally, in addition to its right of subrogation, the Bill provides that an insurer may seek damages against a responsible party for a climate disaster, extreme weather, or other events attributable to climate change.

Make no mistake: the responsible parties driving climate change are fossil fuel businesses.

Insurers Must Stop Fanning the Flames of Climate Risk

SB222 highlights that the real culprit of the climate emergency is the fossil fuel sector. But insurance companies are far from innocent bystanders. By supporting “business as usual” in the fossil fuel sector, insurance companies are facilitating the escalating climate crisis, causing climate change-induced events like the LA fires. When coupled with their representations around protecting policyholders from peril and their justifications for rate hikes and non-renewals, insurers’ conduct violates consumer protection laws and standards.

Insurers must no longer be permitted to invest large portions of premium income in fossil fuel companies and underwrite new oil and gas projects while charging some homeowners more for increased climate risk and simply turning others away. Before any further handouts are given to the insurance industry or any more concessions are made to preserve a profit-driven insurance model that may simply be untenable in the age of climate chaos, insurers must stop fanning the flames.